Tiying Media, the leading media operator of commercial buildings, announced that it has successively completed two rounds of financing, B4 and B5. Among them, the B4 round was exclusively invested by Greenland Jinchuang. And the B5 round was led by the old shareholder Bo Jiang Capital, followed by Korea Mirae Asset and Blueprint Venture Capital. So far, Tiying Media has completed three rounds of financing within six months following the announcement of the B3 round of financing in May this year. From the perspective of shareholder structure, Tiying Media has assembled a variety of investor blessings, including top VCs such as Sequoia China and IDG Capital, Internet giants such as Tencent and Baidu Ventures, as well as upstream and downstream strategic investors such as 58 same city, Maoyan Entertainment and Greenland Jinchuang. The rapid development of Tiying Media is inseparable from its unique digital gene. After this financing, in addition to continuing to expand the scale of outlets, Tiying Media will continue to lead the digitalization of offline media.

After Tiying Media's B3 round of financing, its goal is to achieve the coverage of 100 cities, 100,000 elevators, and 100 million people in one year, which is currently expanding quickly. It is believed that the delivery of rounds B4 and B5 will continue to consolidate this goal and achieve even greater progress. More importantly, thanks to the digital foundation and innovative genes of Tiying Media, the company has realized a variety of changes in its business model, and achieved full profitability with its asset-light model and efficient operation efficiency. This is one of the few profitable national companies in the building media industry after Focus Media.

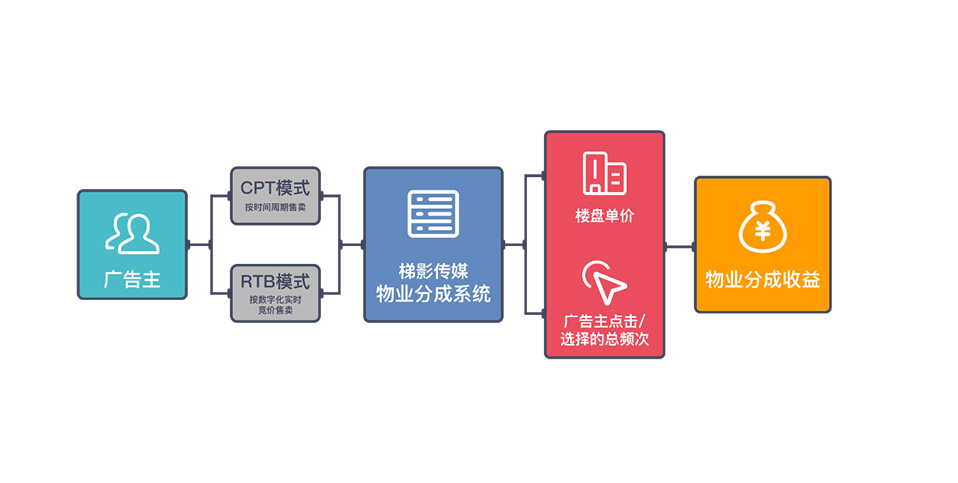

The two ends of building media operations are property management and advertisers. On the upstream property management side, the traditional way of cooperation is to give the property a fixed annual rental income, that is, the lease model. The disadvantage of this model is that when the media owner dominates with high profits, it will compress the rent to the property and achieve a super high gross profit margin. In addition, all rent pricing has no reference basis and is more artificially manipulated. Since last year, Tiying Media has boldly subverted the original leasing model and changed to cooperate with the property in a "sharing model". This model is based on the digital publishing method of Tiying, which provides real-time monitoring of the property backstage, and can clearly know the production capacity of each Tiying media every day. And the revenue of each building is based on the advertiser's selection rate, that is, "work more, gain more." This business model breaks the ceiling of fixed income under the original lease model of the property, giving the property more room for imagination, and truly achieves a deep bond between the media owner and the property management, sharing the glory and disgrace. At the same time, it also broke the situation that ladder media companies need to re-assess their assets to expand their positions in advance, and then do sales feedback to realize the rapid growth of position development and advertising sales spiral.

For the downstream advertisers, the traditional way of cooperation in the ladder media industry is to sell by CPT, that is, the unit price depends on per ladder per week. Relying on its compulsory media effect in this sector, Tiying Media still grabs a lot of customer with the repurchase rate of major customers being close to 100%. The core logic here is that the effective traffic of offline media is getting less and less, and the exposure of a large number of media does not mean being watched by users. Undoubtedly, Tiying is the media with the highest effective reach in the elevator scene. In addition to this traditional sales method, Tiying also relies on its digital solutions to give advertisers more choices. For example, they can buy by CPM just like online media. In addition, Tiying's RTB real-time bidding system has API docking with platforms such as Alibaba Youmeng, Jingtou Pingguo, and Baidu Juping, which can achieve tens of millions of data interactions per day, facing hundreds of thousands of customer resources based on these platforms to realize a brand new track that cuts into the digital sales of offline media. What's more, the online "Tiying Online" applet system allows regional small and micro businesses to independently upload materials, select journals, and pay for invoicing to easily realize small B or even C-end users to place Tiying. The promoter of this sector's business is the property management that is officially fighting side by side with Tiying. In the advertisement release monitoring link, Tiying is also the first to develop a device to automatically capture the published pictures. Advertisers can check the real-time publication status of any Tiying picture across the country through a small program.

Not only did Tiying Media innovate various business models in the upstream and downstream of the company, the company also achieved a huge leap in urban development. Tiying currently covers more than 60 cities around the world, which is divided into two modes: wholly-owned and cooperative. It is expected that from the second half of the year, Tiying Media will launch an acquisition plan for key cities with good operating conditions. In the future, it will sprint to the capital market with its partners for about three years. It is estimated that Tiying will hold more than 10 first-tier and quasi-first-tier cities by the end of this year, and will increase its holdings in second-tier cities to reach 20 by the end of next year. In short, Tiying Media will continue to increase the digital transformation of offline media, leading the industry and online media to do more integration, and gradually pulling the boundary of Tiying Media to a higher level. At the same time, it will try more business model innovations to drive healthy competition in the industry and give greater value to upstream and downstream partners.

Metalenz Raises $30 Million Series B Led by Neotribe Ventures to Address Fast Growing Demand for its Breakthrough Metasurface Optics.

Sherlock Biosciences Raises $80 Million in Series B Financing to Democratize At-Home Diagnostic Testing

BV Family丨SynSense has completed nearly 200 million yuan in Pre-B round of financing

BV Family丨Tiying Media has completed two consecutive rounds of financing, B4 and B5, to promote business model innovation with digitalization.

BV Family丨Defan Information has completed the Series A financing to build a new wave of digitalization of "low code + AI" PaaS platform.

BV Family丨Precision Scientific has completed 150 million yuan in Series B financing, and uses multi-omics data mining to drivenew drug research and development.

BV Family丨Focusing on the Internet of Things SaaS platform services in the commercial concrete industry, Xinzhiwei has completed an angel round of financing of tens of millions of yuan.

BV Family丨 Ruishun Biotechnology has completed 100 million yuan A round of financing to accelerate the development of spot general-purpose DNT cell drugs.

BV Family丨Received investment from Hillhouse Lenovo Baidu, RISC-V startup Ruisichip completes A+ round of financing

First issue丨Baidu's third phase of venture capital fund is completed with 400 million US dollars continuing to invest in emerging technology fields.

BV Family丨Eridi has completed B round of financing and continues to lead the intelligent market for environmental-protection water

Using this website means that you agree to our use of cookies. We use cookies to provide you with a good experience and help our website operate effectively.